Job Market, Inflation and Housing

Did you know that the inflation and employment rates can strongly influence the housing market? Currently, both these factors have led to challenges relating to housing affordability.

The Job Market and Rising Prices:

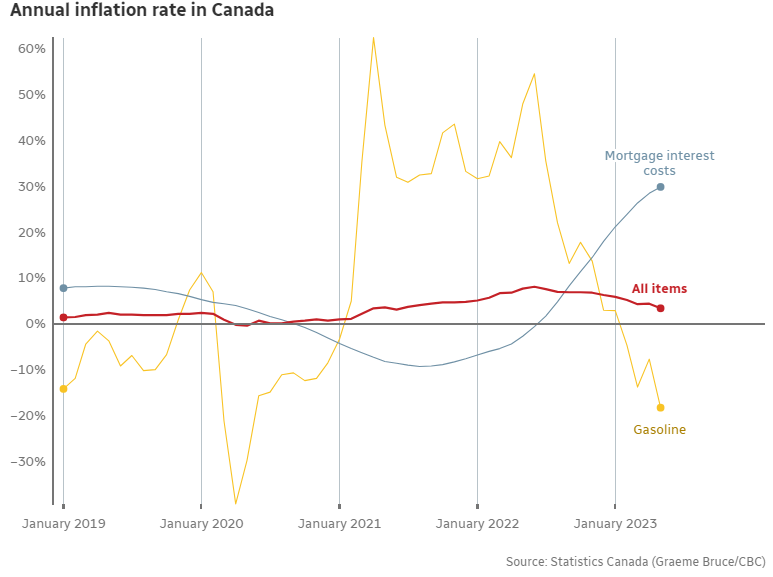

Employment drives economic well being. Lots of jobs means lots of spending and when product demand goes up, prices go up and this leads to inflation. In order to keep inflation in check, the Bank of Canada raises the interest rates (cost of borrowing) to cool consumer spending. At present, however, there seems to still be a pent up demand from the pandemic. Ongoing demand for goods has led to an increased demand for employees and companies still continue to generate profit – leading to more inflation.

The Impact of Rising Prices:

While recent news reports have shown a slowdown on inflation, cost of living is still high, affecting the housing market. One major consequence of rising prices is that it has become more expensive to build new homes. Builders are struggling to afford materials and pay their workers, which means they can't offer affordable housing options. This has resulted in limited choices for potential homebuyers and slower sales in the real estate market.

[Image: Inflation Rate Graph]

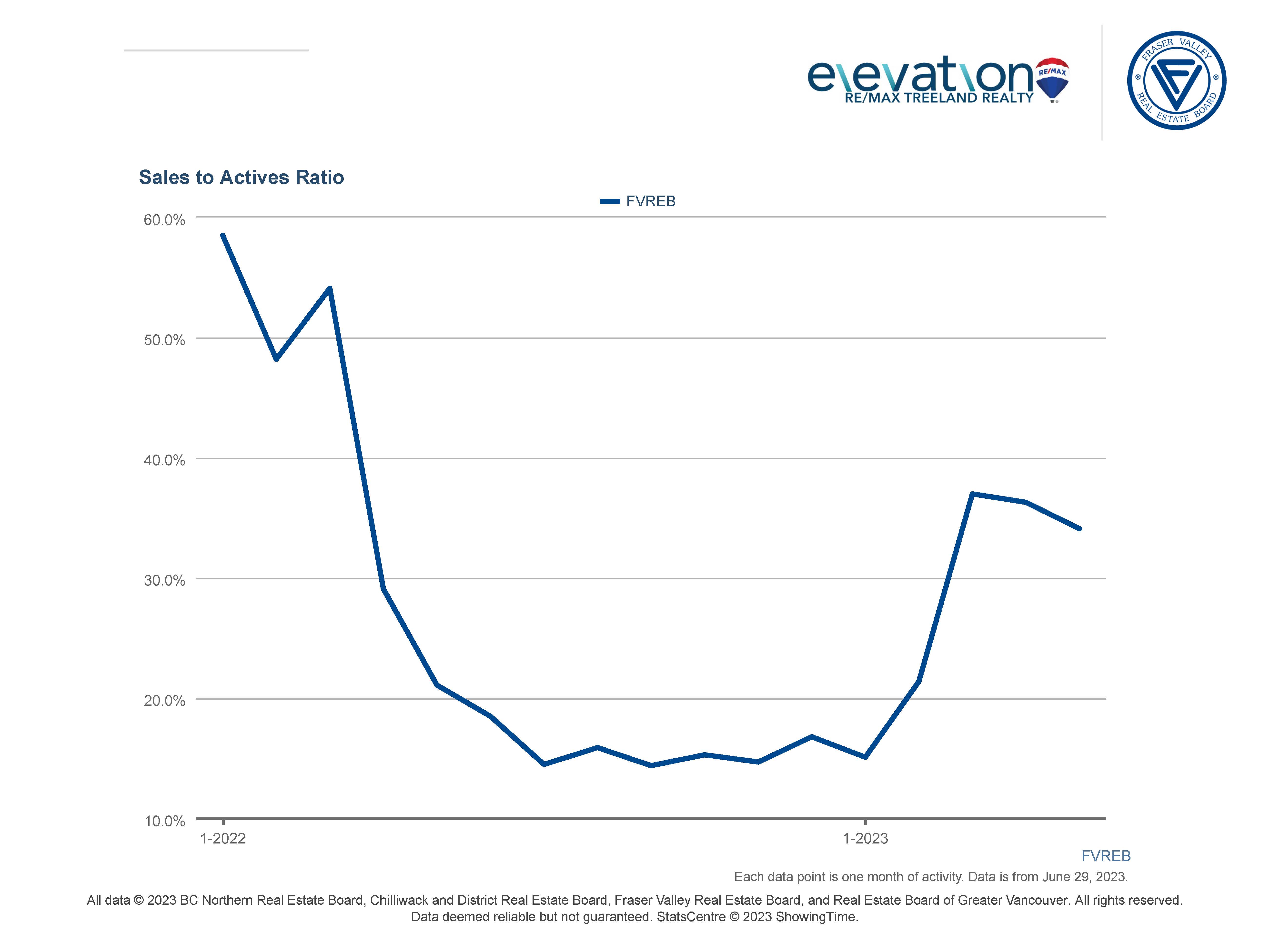

[Image: Stats Centre 1 year Sales/Active Ratio]

Real Estate Market Overview:

In the Fraser Valley, the real estate market had its slowest start in ten years, with fewer new listings than usual. This has led to increased competition among potential buyers, driving up prices. Coupled with the rising interest rates, this makes it even harder for first-time buyers and those on a tight budget to find an affordable home.

Conclusion:

For home buyers & home sellers, it’s essential to understand the impact of rising inflation and employment rates. Affordability concerns and competitive conditions require close collaboration with your trusted Realtor and Mortgage Broker. They can provide guidance during the home sale and/or purchase journey. By staying informed and seeking professional advice, individuals can navigate the market with confidence, maximizing opportunities while ensure financial well being.

Elevate Your Real Estate Experience:

Our team at Elevation Real Estate Group is ready to guide you through the ever-changing housing market. Don't miss out on valuable insights and expert advice. Contact us now to unlock the opportunities that await you!

References:

https://www.cbc.ca/news/business/inflation-rate-may-1.6889725

https://www.cbc.ca/news/business/cpi-complicated-column-don-pittis-1.6889897

https://www.fvreb.bc.ca/statistics/fraser-valley-real-estate-sales-record-slowest-annual-start-in-ten-years-january-new-listings-lowest-in-over-thirty-years-2-2-2/

https://stats.fvreb.bc.ca/infoserv/s-v1/5Eyv-hbl